Being an investor, however, your options usually are not restricted to shares and bonds if you choose to self-direct your retirement accounts. That’s why an SDIRA can renovate your portfolio.

Even though there are numerous Advantages linked to an SDIRA, it’s not with out its individual disadvantages. A lot of the common explanations why traders don’t decide on SDIRAs consist of:

This features being familiar with IRS polices, controlling investments, and averting prohibited transactions that may disqualify your IRA. An absence of data could result in high priced issues.

Variety of Investment Selections: Ensure the supplier enables the kinds of alternative investments you’re enthusiastic about, such as property, precious metals, or personal equity.

Whether you’re a money advisor, investment issuer, or other financial Specialist, explore how SDIRAs may become a strong asset to improve your online business and attain your Experienced objectives.

And because some SDIRAs for example self-directed traditional IRAs are matter to demanded minimum distributions (RMDs), you’ll have to prepare ahead to make certain you may have plenty of liquidity to satisfy The principles set with the IRS.

No, you cannot spend money on your individual enterprise with a self-directed IRA. The IRS prohibits any transactions among your IRA as well as your personal business enterprise since you, given that the operator, are considered a disqualified human being.

SDIRAs are frequently used by arms-on traders who will be prepared to take on the challenges and responsibilities of selecting and vetting their investments. Self directed IRA accounts may also be perfect for investors who definitely have specialised understanding in a niche sector they would like to put money into.

Complexity and Obligation: With the SDIRA, you might have additional Management in excess of your investments, but you also bear much more responsibility.

In some cases, the expenses linked to SDIRAs might be better plus much more challenging than with a regular IRA. It's because from the amplified complexity related to administering the account.

IRAs held at banking companies and brokerage firms supply confined investment alternatives for their clients as they do not have the knowledge or infrastructure to administer alternative assets.

Feel your Good friend may very well be starting off the subsequent Facebook or Uber? With the SDIRA, you'll be able to invest in causes that you suspect in; and possibly appreciate bigger returns.

Not like stocks and bonds, alternative assets will often be tougher to promote or can have rigorous contracts and schedules.

Constrained Liquidity: Many of the alternative assets that could be held in an SDIRA, which include real-estate, non-public equity, or precious metals, is probably not very easily liquidated. This may be a problem if you might want to accessibility funds promptly.

Many investors are astonished to learn that working with retirement resources to invest in alternative assets is achievable considering that 1974. Nevertheless, most brokerage firms and financial institutions focus on giving publicly traded securities, like shares and bonds, since they absence the infrastructure and abilities to deal with privately held assets, like real estate property or non-public fairness.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the purpose of generating fraudulent investments. They often idiot buyers by telling them that In case the investment is accepted by a self-directed IRA custodian, it have to be authentic, which isn’t correct. Yet again, make sure to do comprehensive research on all investments you decide on.

When you’ve located an SDIRA company and opened your account, you may well be wondering how to actually commence investing. Knowledge both of those The foundations that my site govern SDIRAs, as well as how you can fund your account, will help to this contact form lay the foundation for the way forward for prosperous investing.

Ahead of opening an SDIRA, it’s crucial that you weigh the likely positives and negatives based upon your distinct economic objectives and risk tolerance.

If you’re hunting for a ‘set and forget about’ investing method, an SDIRA probably isn’t the correct choice. Since you are in whole Regulate about every investment made, It is up to you to carry out your personal due diligence. Remember, SDIRA custodians aren't fiduciaries and can't make tips about investments.

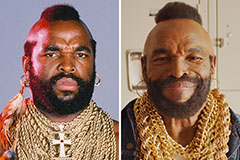

Mr. T Then & Now!

Mr. T Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!